The Humble Dividend

June 7, 2023

Dividends may be the secret sauce of investing, by some measures accounting for the majority of the market’s long-term return.

Dividends are a return of profits to shareholders. Typically paid quarterly, they are a reward, a cash return on your investment. Using Exxon Mobil (XOM) as an example, it currently pays a quarterly dividend of $0.91 per share. With XOM shares trading at $105, its “yield” is 3.5% [($0.91 x 4) / $105].

Some think of dividends as a side benefit of owning stocks, where the real return comes from share price appreciation – the “buy low, sell high” mantra.

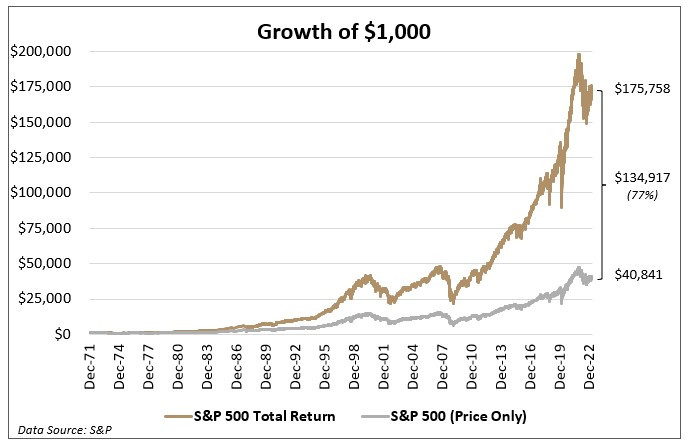

The math, however, shows that the humble dividend has been responsible for 77% of the market’s return. From December 31, 1971 to the end of 2022, $1,000 invested in the S&P 500 would have grown to $40,841 due to price appreciation – which isn’t a bad return. On a total return basis though – including both price gain and the payment of dividends – the $1,000 investment would have grown to $175,758. The extra $134,917 in return, or 77% of the total, is thanks to the payment of dividends.

To be clear, the actual payment of dividends didn’t account for 77% of the market’s return. The payment and reinvestment of dividends did. Using your dividend payment to buy more shares – and letting that investment compound on itself – generated the extra $135,000 of return. That is why, at Allied, two keys of our investment philosophy are finding sustainable dividend payers and letting compounding work for us.

No matter how you run the numbers, dividends are a building block to solid long-term performance.

The dividend story gets even better though, as dividends aren’t fixed. Historically, they grow, providing a built-in inflation hedge and source of income growth. Unlike bonds, which pay a set rate for their lifetime, many companies raise their dividend every year.

Take Deere & Company (DE). 5 years ago, DE was paying a quarterly dividend of $0.60 per share. Today it pays $1.25, which is a 16% annual growth rate. In 5 years, the income you receive from Deere & Company has more than doubled. (Disclosure: this is historical data; what DE does with its dividend in the future is up to its Board of Directors).

There are companies with storied histories of raising their dividends every year. Procter & Gamble (PG) has paid a dividend every year since 1891, and raised its dividend every year for 66 consecutive years. Emerson Electric (EMR) has raised its dividend every year for 65 consecutive years. When you’ve raised your dividend every year since Dwight Eisenhower was in the White House, that’s a pretty good track record.

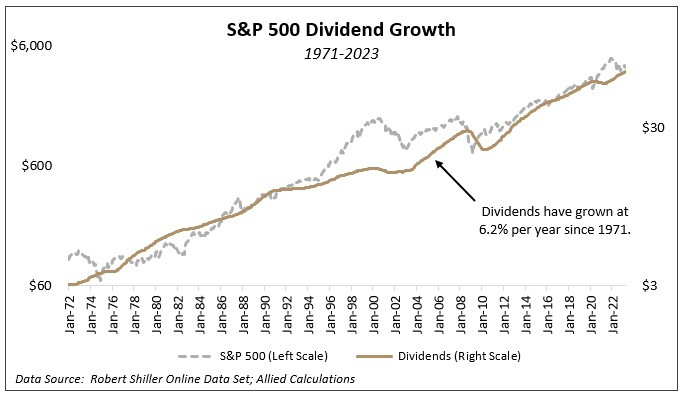

Since 1971, the S&P 500 has grown its dividend payout at an average of 6.2% per year. This has outpaced the rate of inflation (the Consumer Price Index [CPI] has grown at 3.9% per year since 1971), giving you a rising REAL (after inflation) stream of income. Dividends are also less volatile than the market. As the graph below shows, dividends don’t see the up and down volatility of the market, giving us a steadier, rising income stream over time.

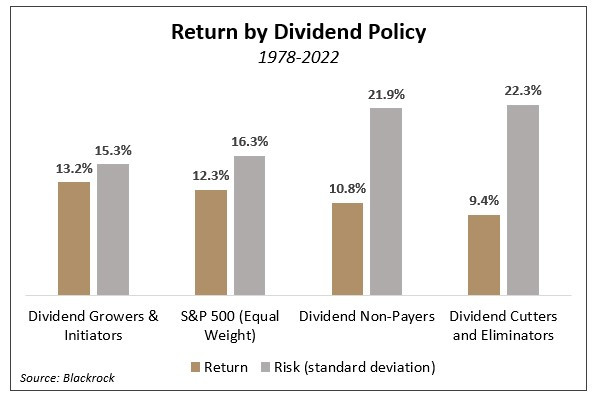

With the tailwinds mentioned above, companies paying dividends are some of the best performing and lowest risk stocks available. The chart below shows that the highest performing segment of the market from 1978-2022 was Dividend Growers and Initiators (brown bars). They outpaced both the broad market (S&P 500), and Dividend Non-Payers. Dividend cutters were a distant last place. When it comes to risk (grey bars), the numbers continue to favor dividend growers. They had the lowest standard deviation (volatility) of any of the four dividend policies.

A company’s dividend policy can make a big difference to your investment return and risk. They can offset inflation, lower portfolio volatility, and – over time – create a compounding stream that outpaces your original investment. While they may seem boring, the humble dividend really can be the secret sauce to long-term performance.

If you have any questions about your account(s), or if there has been a change in your financial situation or investment objectives, please feel free to contact any member of our team at (406) 839-2037 to schedule a meeting.